The influence of mobile technology on retail in this century has been truly astounding. By 2003, 95 million people around the globe made a payment via their mobile device. By 2015, there were 500 million users making 50 billion transactions for a total volume of 610 billion USD. With mobile wallet growth on the rise, could it be the next subset of mobile commerce to reap the benefits of a mobile hungry populace? Over the last five years, m-commerce has enjoyed a 30% compound annual growth rate (CAGR) that is showing little sign of slowing down. If brick and mortar retail is still king, what will it take to bring mobile wallet adoption out of the hands of early adopters and into the hearts and minds of shoppers worldwide?

The first real attempt to launch a mobile wallet came in 2011 with the release of the aptly named Google Wallet. According to Russ Jones, an analyst at Glenbrook Partners, “The Google offering proved mobile wallets could work, but its system was flawed because it was based on a laundry list of requirements that few consumers could fulfill. First, users had to have the right device—one of only a few that contained near-field communication (NFC) chips at the time. They also had to have the right Android operating system and a data plan with Sprint. They had to have a card that not only came from one of just a couple of participating issuers but also had been designated for use in the mobile wallet.” People were not breaking down doors to avail themselves of the service.

It does not always pay to be first, if you will pardon the pun, and the Google wallet soon found itself to be a solution without a problem. Why go through the rigmarole of setting up a wallet on your phone when most users keep their payment cards next to their phones anyway? Google fought hard, but in the end, consumers voted with their wallets and the Google Wallet disappeared without a whimper. In 2015, what was Google Wallet became a P2P payments service and later that year, Google spun the wallet (or in-store payment component) into what was known as Android Pay. As if the water wasn’t muddy enough, last month, the two products became one yet again and have been rebranded as “Google Pay.”

So where do we go from here: chaos or community?

-Dr. Martin Luther King

“The graveyard of mobile wallets is filled with some high-profile names,” according to Eric Grover, principal at Intrepid Ventures. “In every country, carriers thought they could band together and control the mobile wallet,” he says. “That belief turned out to be wrong.”

Traditionally mobile wallets could be grouped into three categories:

- Mobile manufacturers and platforms like Samsung, Apple or Android (the Pays)

- Retail based platforms like Starbucks, Dunkin’ Donuts or Walmart

- Banks such as Capital One, or Chase

The challenges faced by all three of these mobile wallets are perception and adoption. Think about it from a consumer standpoint, is it easier to find your mobile phone, unlock it, open the payment app, unlock that and then make a payment, or to simply pull a payment card out of your wallet and make your purchase? Odds are, you, like most consumers, might just opt to reach for your payment card. According to a recent Retail Dive study, fewer than one in 20 consumers who has a major mobile digital wallet app — a group that includes Apple Pay, Samsung Pay and Android Pay — uses the app when the opportunity arises. Why is that? Ease of use may be a factor, but with advancements in biometrics, app functionality is getting progressively easier. So what will it take to move the majority of consumers from a physical to a digital wallet? It might be as simple as taking a look at what’s in the average consumer’s physical wallet today

“Brands constantly look for new channels to engage with consumers and mobile wallets are often underutilized—yet promising—tools that can do just that. People use physical wallets to hold their rewards cards, gift cards and more—and expect the same capabilities from their mobile wallets. But until a mobile wallet can provide the same functionality as a physical one, there’s no reason for consumers to leave their leather billfold at home.”

-Theresa McEndree

Payments and Loyalty, a Winning Combination?

The average US household is enrolled in more than 18 customer loyalty programs, but is only active in eight. What is holding consumers back? According to macorr.com, 26% of North American consumers will stop using a loyalty program if it doesn’t have a smartphone app and a whopping 69% of consumers would be more likely to use a loyalty card if it was on their phone than in their wallet. The secret is out; the key to mobile wallet adoption isn’t payment, but rather, loyalty.

The lesson to draw here “isn’t that wallets are dead, but that the providers, and innovators, really need to focus on features — or something — that will get consumers, and merchants, excited.”

–Karen Webster, PYMNTS CEO

According to a recent article by Theresa McEndree, a survey of over 1500 adults in the spring of 2017 found that consumers report higher levels of engagement with the brands to which they are most loyal. Furthermore, seventy-six percent of the respondents said an easy payment process would make them more loyal. These same respondents reported more frequently engaging with their favorite brands through various marketing vehicles such as rebates, gift cards, e-gifts and more.

By uniting these insights to create an integrated mobile-wallet experience that combines payment and incentives, merchants can benefit from the following:

- Regular consumer engagement: Companies can leverage brand loyalty and consumers’ tendency to keep their mobile devices nearby at all times by offering rewards and rebates within mobile wallets to encourage brand interaction. This can extend the customer lifetime and help create and retain loyal customers.

- Positive brand engagement: Consumers who have a seamless mobile-wallet experience are more likely to feel positively toward a brand.

- More effective mobile-marketing tools: Merchants can deliver rewards, like company-branded e-gifts, via mobile wallets quickly, and drive promotion dollars back to their business while creating improved digital connections with consumers.

- Higher in-wallet engagement: Customers won’t be using their mobile wallet only to pay; instead, they will have greater access to earn rewards, redeem rebates, use gift cards and more. When consumers can redeem and earn different incentives using their mobile wallet, they may be more likely to engage with a brand.

“…mobile wallets usually don’t solve any consumer problems or meet any consumer needs.”

– Eric Grover, Intrepid Ventures

How can brands, advertisers and merchants effectively navigate this minefield today? The solution may be right under our noses…by absorbing the functions of loyalty cards, mobile wallets can beat credit and debit cards for convenience.

In October of last year, Kohl’s Pay let users redeem Kohl’s Cash and coupons, accrue rewards, and pay with the retailer’s branded charge card—in one-step. In another example, Starbucks’ wallet lets customers earn free drinks and order and pay ahead; it makes up about 25 percent of the chain’s U.S. transactions.

Retailers Win:

Customers who use a store’s loyalty program tend to shop there more frequently and buy more each time; and about 70 percent of consumers are likelier to join a loyalty program if their points and rewards become immediately visible on their phones, says mobile-marketing firm Urban Airship.

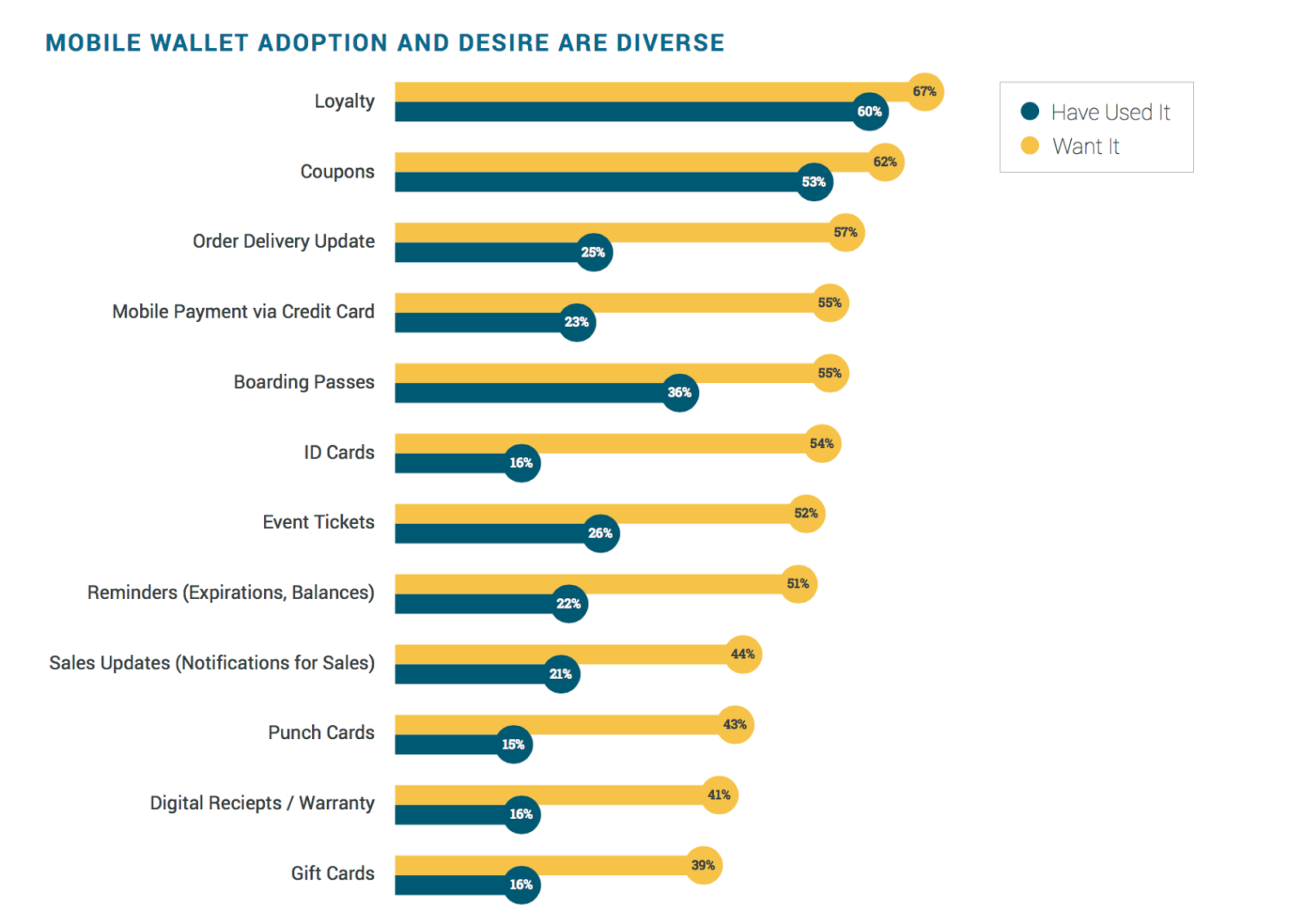

Image via: Urban Airship

“Combining loyalty and payments lets retailers woo new users, especially smartphone-savvy millennials.”

“Whether you’re launching or relaunching your loyalty program, you must consider [your] brand, customer base, and cost structure when designing a program,” writes Nick Winkler for the Shopify Plus blog. “While each plan requires customization, research indicates programs built on customer needs and integrated with overall company marketing goals can result in lower than expected costs and higher than anticipated returns.”

What’s Holding Merchants Back?

The migration of a mobile wallet from a payment only instrument to a diverse, effective tool for marketers and brands to connect effectively with their consumers in order to bring value to every step of the chain is taking place across all verticals today. The ‘Pays’ are leading the way by providing the ability to include any number of loyalty rewards programs into their existing wallets, but they still have a lot of work left to do.

What will it finally take to bring the majority of consumers out of their shells and into mobile wallets? According to Karen Webster, CEO of PYMNTS.com, “Mobile wallets aren’t attracting much consumer interest. With Apple Pay the oldest regularly clocking in between 4-5% of people who could use their wallet actually using it. The lesson though, isn’t that wallets are dead, but that the providers and innovators really need to focus on features— – or something —- that will get consumers, and merchants, excited.” New features such as hyper-local marketing, in-app couponing, flash sales and deals will go hand-in-hand with the standard payment offering. Until consumers look to their phone as a platform on which they can interact with a number of brands, merchants and loyalty programs, they will see the mobile wallet as nothing more than a curiosity, or a safety feature, in case they leave their wallet at home.

The jury is still out on Google’s latest payment product. Will the combination of in-app payment, P2P transfers AND in-store functionality be enough to tip the scales of consumer adoption? Only time will tell, but one thing is clear: consumers are clamoring for the ability to do more than transfer money from one account to the other. They want a digital wallet that can truly take the place of a billfold good word that could be used elsewhere rather than wallet. That means digitizing all of their loyalty cards, consolidating all of their retailer, manufacturer and loyalty offers in one convenient place AND a way to pay for a quart of milk. When any wallet can do all of these things, we will begin to see people confidently leave their billfolds at home.

At POPcodes, we endeavour to bridge the gap between the mobile wallet and the in-store experience. We work to enable brands to get to know their consumers through the existing points of contact in a merchant location such as payment terminals or in-store peripheries. Mobile wallets have a good deal of growing to do, but they won’t fully realize their potential until they are of use to all consumers and merchants alike. Once that happens, we believe that people begin to leave their wallets at home, on purpose, and really leverage the mobile wallet to its fullest potential. For more information about how POPcodes can improve the omnichannel experience in your store, click on the Contact Us section of our home page, or go old school and give us a call!